In Malaysia, Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949 (“the Act”). In general term, stamp duty will be imposed to legal, commercial and financial instruments.

There are two types of Stamp Duty namely ad valorem duty and fixed duty. For the ad valorem duty, the amount payable will vary depending on type and value of the instruments. For fixed duty, generally the amount payable starts at a nominal value of RM10 per instrument.

An instrument is required to be stamped within 30 days of its execution if executed within Malaysia. If the instrument is executed outside Malaysia, it must be stamped within 30 days after it has been first received in Malaysia.

In this section, we will explain about the stamp duty procedures in Malaysia and the importance of having your instruments or documents stamped in accordance with the law.

2.Examples of Instruments / Documents Subjected to Stamp Duty

2.1 First Schedule of Stamp Duty Act 1949 laid down all the types and categories of instruments subject to the specific stamp duty. It includes certain exception where stamp duty will be exempted. Among the example of the instruments subjected to stamp duty are as follows:

2.2 The rates of duty vary according to the nature of the instruments and transacted values.

a. Shares Transfer

b. Real properties Transfer (Sale and Purchase of Land, Houses, Buildings, etc.)

c. General stamping of contracts / agreements

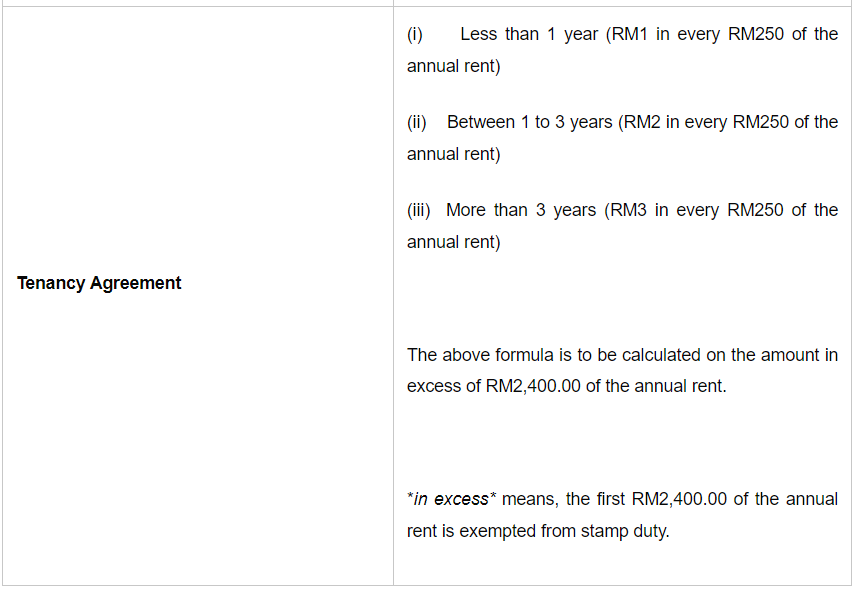

d. Tenancy, lease or rental agreements

e. Security documents

f. Selling of annuity

2.3 Example of the calculation of the stamp duty are as follows:

(i) Government contracts (such as service agreement entered by the governmental bodies / ministries)

(ii) Instruments relating to merger and acquisitions executed by small and medium enterprises (“SMEs”)[2]

(iii) Instruments in connection with the transfer of property or shares between associated companies[3]

(iv) Certain exemption provided by the government which announced from time to time (e.g. exemption on instrument on purchase of low-cost houses, purchase of first residential property, etc.)

3.Why Document / Instrument should be Stamped?

Stamp duty is chargeable on instruments and not on transactions. If a transaction can be affected without creating an instrument of transfer, no duty is payable.

3.1 Validity of the unstamped instruments:

The Act does not state clearly whether or not unstamped instruments are valid and enforceable. The legal position to address the issue of the validity of unstamped instruments (particularly, a contract) was established in a case of Malayan Banking Bhd v Agencies Service Bureau Sdn Bhd & Ors (1982) 1 MLJ 198 where it was held that unstamped instrument only affects the admissibility of the instrument in evidence, but it does not render that particular instrument to be invalid. Hence, the contract is still rendered enforceable but inadmissible in court as evidence.

3.2 Admissibilty in court

Section 52 of the Act stipulates that the instruments specified under the First Schedule of the Act must be duly stamped by the Lembaga Hasil Dalam Negeri (LHDN) which translate to the Inland Revenue Board of Malaysia (IRB).

The stamping must be done in the manner specified under Section 40 and Section 47 of the Act to enable the instruments to have a complete legal effect by being admissible in court as evidence. As mentioned at the above, an unstamped or insufficiently stamped instrument is not admissible as evidence in a court of law, nor will it be acted upon by a public officer.

3.3 Effective Stamped Instruments

Notwithstanding the legal position of the unstamped contract at the above, certain instruments in Malaysia are required to be stamped in order for it to be effective. The prominent example of such instrument is the instrument of transfer of properties to transfer tangible assets like real estate or company’s shares. The relevant authorities who are responsible to affect such transfer and registration of the new proprietor or owner will require the instruments to be paid in accordance with the chargeable stamp duties in accordance with the First Schedule of the Act.

The example of stamp requirement for transfer of shares is provisioned in Section 105(1) of the Companies Act 2016 where it provides that shareholder may transfer his share by a duly executed and stamped instrument of transfer prescribed under the Companies Act 2016.

In addition to the above, Section 4A(1) of the Act particularly addressed the requirement of the instrument executed outside of Malaysia for transfer of movable or immovable property situated in Malaysia (other than debentures or shares) shall be stamped accordingly in order for the transfer to be effective.

As mentioned at the above, the instruments subjected to stamp duty must be stamped within the stipulated time. Section 47A of the Act provides that an unpaid instrument will be payable together with the penalty as follows:

4.How to proceed with stamping

Firstly, the instrument must be submitted to the Inland Revenue Board (LHDN) for their assessment of the duty payable.

Secondly, upon assessment has been completed, the LHDN will issue the Assessment Notice containing the amount of the duty payable (inclusive of the penalty, if any) within certain timeframe.

Thirdly, upon successful payment of the stamp duty, the instrument will be stamped by franking machine or a stamp certificate will be issued, depending on the method of stamp application was made.

The above process may be completed either on the LHDN officer at the counter or via the electronic system provided by the LHDN i.e. the Inland Revenue’s Stamp Assessment and Payment System (STAMPS system).

5.Conclusion

Our firm provides advice on the dutiable instrument to identify if the instrument is subject to any payable stamp duty in accordance with the law together with the applicable stamp duty amount. We are also a registered agent to submit the electronic assessment to the LHDN and apply for payment of stamp duty for certificates to be issued accordingly.